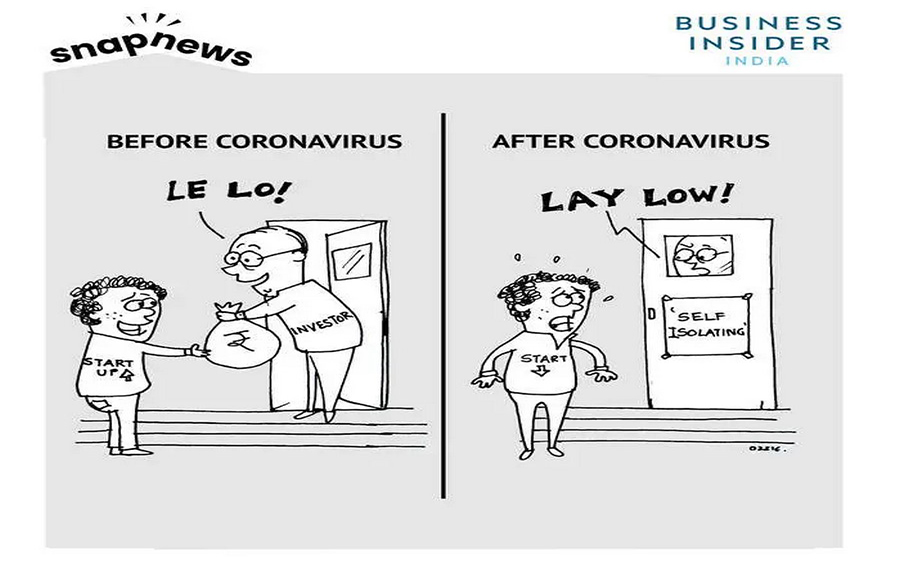

The Covid-19 pandemic has significantly impacted Indian startups, forcing many founders to confront unprecedented challenges. While some sectors like education, healthcare, entertainment, and fintech might manage to withstand the crisis, others face prolonged periods without revenue and potential shutdowns.

Navigating Uncertain Waters: Guidance from Leading VCs

The pandemic has created a funding crunch and fluctuating valuations, complicating the decisions for startup founders. Recognizing this, prominent venture capital firms in India, including Sequoia India, Matrix Partners, SAIF Partners, Lightspeed Ventures, Kalaari Capital, Accel, Chiratae Ventures, Omidyar Network, and Nexus Partners, have shared their collective insights and recommendations.

These VCs published their guidance on Twitter to ensure wide accessibility. They acknowledged the unprecedented nature of the crisis, stating, “We’re in uncharted waters and founders are faced with their toughest decisions yet. Some of us in the VC ecosystem have put together learnings from our best founders. While in no way exhaustive, we hope it serves as a good starting point for founders in a tough time.”

Comprehensive Resource on Notion

The advice, compiled into a document titled “Best Practices for Founders in the wake of COVID-19,” is available on Notion, a platform for notes and collaboration. The document covers various crucial topics, including scenario planning, fundraising, company restructuring, business continuity planning, strategic relationships, mergers and acquisitions, and work-from-home ethics.

The VCs emphasized the importance of both short-term tactical decisions and long-term strategic planning. They advised, “Founders will inevitably be faced with difficult decisions, tactically on execution for the next 21-30 days, and strategically on how to plan for the next 12-18 months.”

Dependency on Global Capital

The document also highlighted the reliance of Indian startups on international capital, particularly from the US and China. The VCs noted, “India’s startup system doesn’t operate in isolation and in fact, is dependent on external capital primarily from the US and China. It’s likely that the Indian mid to late stage startup financing market will see a rebound only after their ‘home’ markets rebound. So even if India escapes the Covid-19 crisis, we will still have to wait for the rest of the world to come back.”

Cost-Cutting Measures and Workforce Management

In their guidance, the investors underscored the necessity of cost-cutting and cautious financial management. They advised against new hiring and suggested various measures for reducing expenses, such as cutting down on marketing and conserving capital. Regarding payroll, the VCs recommended involving team leaders in identifying pragmatic yet humane solutions, including salary reductions, shifting to variable pay, salary deferrals, or, as a last resort, reducing headcount.

By sharing these best practices, India’s leading VCs aim to support startups through these challenging times, offering a roadmap to navigate the economic uncertainties brought about by the pandemic.

Leave a Reply